The Future of Commercial Real Estate Valuation

The AI Renaissance

- AI is bringing the tsunami of change to a very antiquated industry

- Speed and efficiency will be catapulted into the 21st century

The biggest hurdle in the transaction process: Appraisal

- Too individualistic

- Subjective and inconsistent

- Outdated amount of emphasis on backward-looking data

Appraisal industry headwinds

- Aging demographic (average age of a commercial appraiser is over 60)

- Commoditization of the appraisal process and high barriers to entry have disincentivized younger generation from career path

- Pipeline of trainees not big enough to sustain the number of expected retirements in the next 5-10 years

Appraisals: Art vs. Science

- Appraiser has full discretion on how market sentiment is derived

- Appraiser's individualistic style disproportionately skews values

A Modern Approach to determining market sentiment: Smitty (CRESI)

- CRESI: Commercial Real Estate Sentiment Index (dubbed "Smitty")

- Proprietary agentic AI economist trained to determine market sentiment

Difference between generative and agentic

Generative AI: Creates images/narratives (think ChatGPT)

Agentic AI: Takes independent actions to accomplish goals and learns from the results

Consistent and methodical approach

- Foundation of Smitty is rooted in a consistent and methodical approach to determining sentiment

- CRESI eliminates subjectivity and ensures every valuation is based on the same rigorous methodology

- Removes feelings out of the valuation adjustment

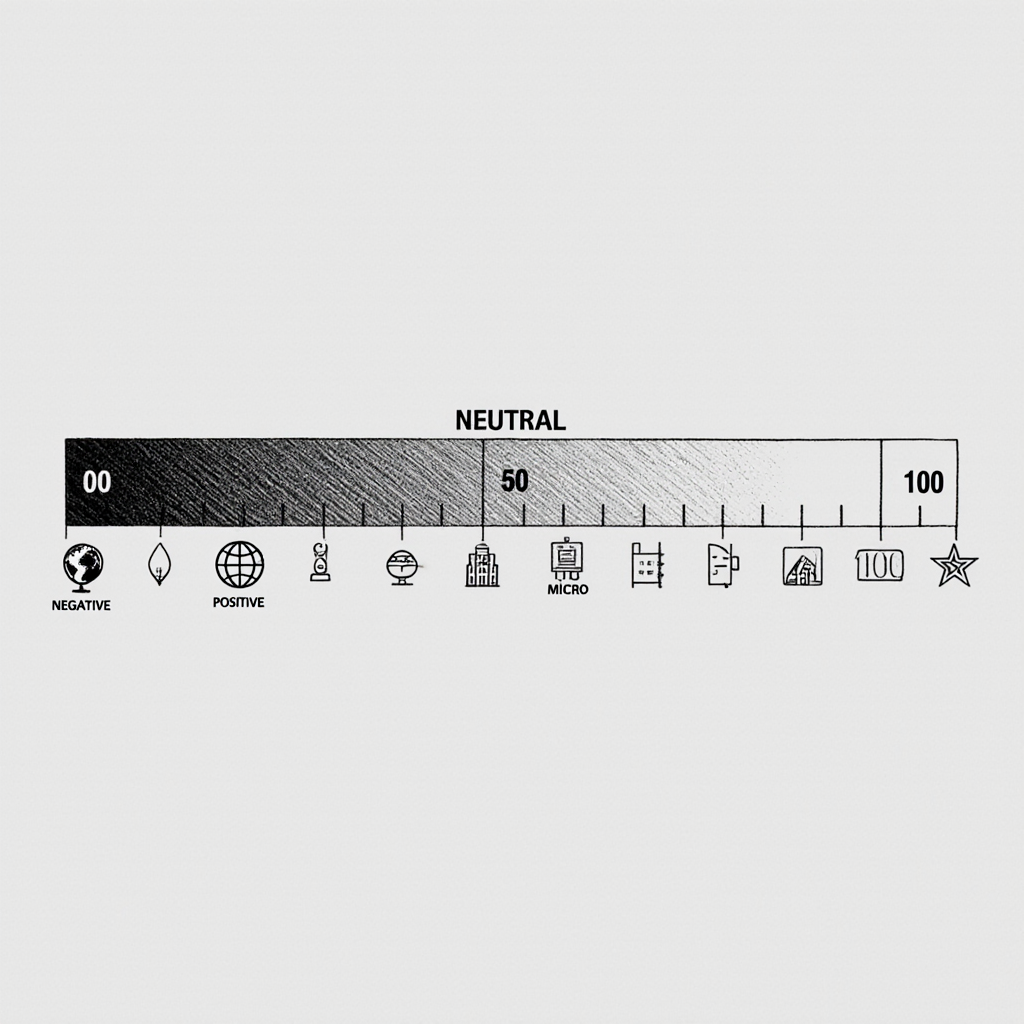

CRESI index converted to adjustment to value

Index layers:

- Macro-economic factors

- Micro-economic factors

- Geopolitical & economic events/considerations

- Capital markets signals

- Demographic and migration patterns of MSA

- Current events commentary

Layers for CRESI index are specifically weighted for each asset class. Each layer is assessed and scored.

Agentic learning process

- Memory bank: Stores all historical data and valuation outcomes

- Self-correcting: Continuously refines its models based on new information

- Constantly improving: Gets smarter with every valuation

Lenders,

Regulators,

Private Market

Who is our user?

- Banks/lenders – potential to license to banking software firms

- Regulators – Appeal to appraisal sub-committee and Fannie Mae/Freddie Mac

- Private market – Investment firms, REIT's, Brokers

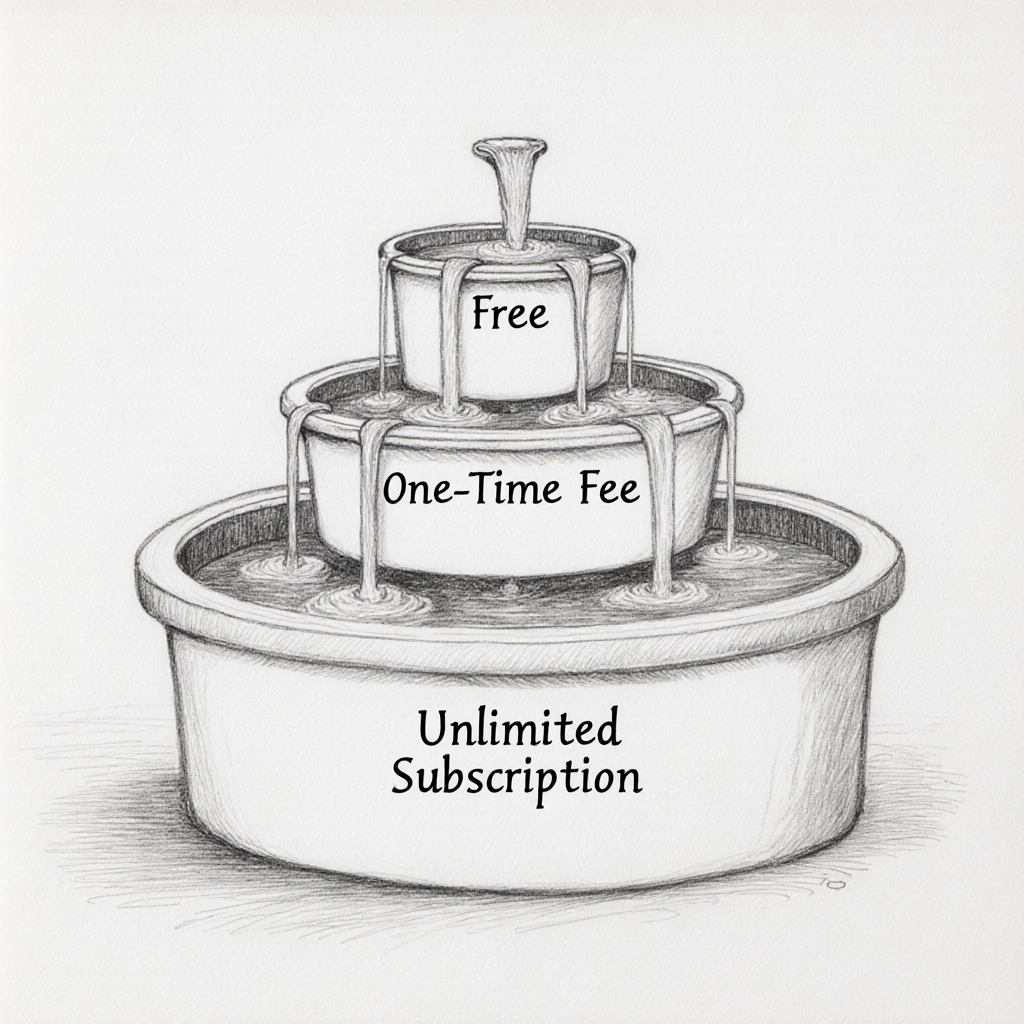

Business Model

- Subscription based model

- Value available with free account

- One-time fee for full property report

- Scalable subscription for paid users to have unlimited access